Employee Support

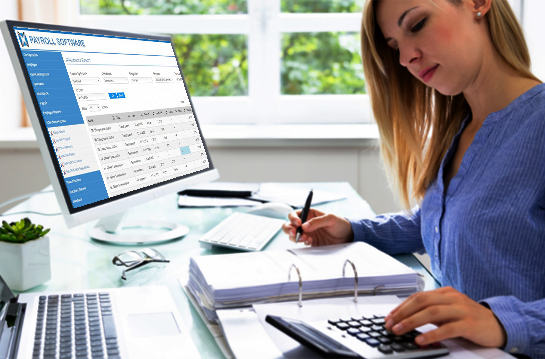

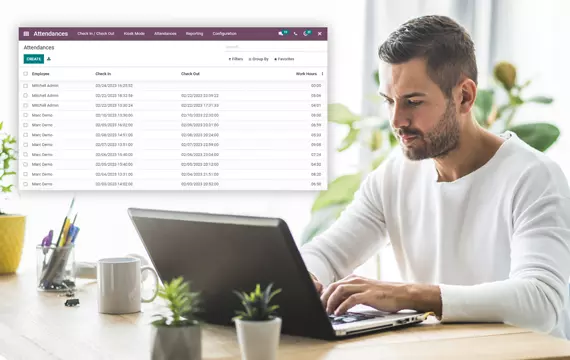

Full support for full-time, part-time, salaried, hourly, and contract employees is offered by Odoo Payroll. Establish employee profiles to retain their contact details, address, filing status, deductions, and payroll details like frequency, payment method, and job type. You can view the attendance, leaves, timesheets, and working hours of employees using the Odoo payroll management system.

The ability to examine contact details, withholdings, deductions, payroll history, pay stubs, tax forms, and more is available to employees via self-service. During open enrollment periods, it is quick and simple to update contact information, and changes to withholdings and deductions can be done online in employee-self service.

USA

USA INDIA

INDIA