ZATCA Implementation Phase 1

This phase is known as the Generation Phase. This phase will require taxpayers to generate and store invoices, and debit/credit notes via electronic systems which must be compliant with Phase 1 requirements. This phase is enforceable as of December 4th, 2021, for all taxpayers ( this phase excludes non-resident taxpayers), and any other parties who are issuing tax invoices on behalf of suppliers are subject to VAT.

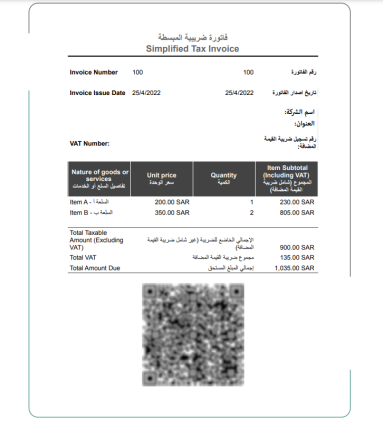

What must be accomplished in ZATCA E-Invoicing Phase 1:

- Update your current invoicing system or install the new ones;

- Adding QR codes to invoices is mandatory;

- Also, you need to add the customer’s VAT registration number, if they are registered for VAT.

-

Barcode Generation

In the ZATCA e-invoicing complaint, there is a rule that all the businesses need to generate the QR code for all the invoices that should provide basic information about the purchase and the seller. The QR code can be scanned by a specialized app, which is a government QR code scanning application, i.e., E-Invoice QR Reader KSA. This application will check if the invoices are in the correct format or not.

-

Government QR Code Mobile App

Government QR Code Scanning app (E-Invoice QR Reader KSA) helps to provide quick information about a particular invoice. Also, it has other critical purposes:

Helps the government to validate the electronic invoices and electronic credit/debit notes.

Further, it helps customers to verify the authenticity of the invoices.

Also, one can evaluate if the invoices comply with the ZATCA requirements.

ZATCA Implementation Phase 2

The second phase is known as the Integration Phase. It will be rolled out in waves by the targeted taxpayer groups. This phase will involve the preface of technical and business requirements of phase 2 for electronic invoices and electronic systems. Also, it will include the introduction of the integration of these electronic systems with ZATCA’s systems. Simply put, taxpayers need to integrate their e-invoicing tools with ZATCA’s system so they can send the generated e-invoices to the Authority portal for validation and verification.

ZATCA published the revamped e-invoicing Implementation Resolution in Arabic on 24 June 2022, after finalizing the public consultation on 10 June 2022. This Resolution is a part of the e-Invoicing Regulations that were released earlier and published on 4 December 2020. This latest Implementation Resolution, technical specifications, and annexes will be suitable for the Second Phase, i.e., Integration Phase, which will go live on 1 January 2023. However, the English version has not been issued yet.

When the 2nd phase will start, the taxpayers need to issue e-invoices in particular formats (i.e., XML or PDF/A-3 format with embedded XML).

Moreover, this phase will have more additional technical and specialized requirements. This is why implementing a system that is in compliance with ZATCA’s guidelines is the best decision for businesses. Your electronic invoicing system must be capable of connecting to external systems with APIs. Also, able to generate or create a Universally Unique Identifier (UUID), supports e-signature or digital signature, a sequential number for the e-invoices (that will further help you differentiates each e-invoice), and allows generating a cryptographic stamp. Moreover, the solution must be qualified with anti-tampering features.

Features that are Mandatory for Phase 2

Types of E-Invoices

Standard E-Invoice (Tax E-Invoice)

Standard e-invoices or tax e-invoices are issued for B2B and B2G transactions. These invoices are generally used for claiming input VAT deduction by customers. Standard e-invoices have a defined format that the seller shares with its buyers. These invoices will be issued to the customers after getting stamped cryptographically and “cleared” by ZATCA in the second phase. (These regulations will be implemented in the second phase from January 2023).

Standard electronic invoices have fields including the vendor and customer information, transaction, and details of goods/services as well as some other technical fields as per VAT legislation, that need to be generated by the e-invoicing solution.

Simplified E-Invoices

Simplified electronic invoices are issued for B2C transactions, these are generated instantly at the point of sale. Buyers do not use these invoices for input VAT deduction. For generating the simplified e-invoices, the solution must generate a QR code with the invoice. QR code generation is essential for validating the e-invoices.

The 1st phase will only need the system to generate the simplified e-invoices. However, once you will move to phase 2, the simple electronic invoices will need to be registered to ZATCA within 24 hours of issuance.

| Transaction type |

Type of E-Invoice to be issued |

| Taxable goods & services valued SAR 1,000 or more (issued to a taxable or non-taxable legal person) |

Standard e-invoice |

| Export of goods |

Standard e-invoice |

| Intra-GCC supplies |

Standard e-invoice |

| Nominal supplies (not given to a buyer, but held for audit intents) |

Standard e-invoice |

| Taxable services & goods, except exports, that are valued at less than SAR 1,000 (issued to a taxable person or non-taxable legal individual) |

Both (Simplified e-invoice or Standard e-invoice) |

| Taxable goods and services (except exports) issued to a non-taxable individual |

Simplified e-invoice |

| Zero-rated goods and services valued SAR 1,000 or above (issued to a taxable individual or non-taxable legal individual) |

Standard e-invoice |

Get ZATCA-Compliant O2b E-invoicing Solution

Comply with the ZATCA e-invoicing software regulations by associating your business to O2b Technologies' robust open-source and cloud solution. We provide an ERP solution that maintains compliance with the regulatory requirements in Saudi Arabia for e-signature, content, reporting, format, etc. Our ZATCA e-invoicing software is compatible with the ZATCA e-invoicing compliance and it ensures that all the e-documents and e-invoices are exchanged in a secure and trusted environment.

Furthermore, you will be able to generate simplified invoices in Arabic language with required invoice information. Also, it has features for generating QR code and will be fully compatible with the official ZATCA’s e-invoicing document guidelines. Moreover, our robust e-invoicing solution is closely integrated with other solutions such as sales, purchase, accounting, inventory, and more. O2b Offers a complete ERP solution and is fully compatible with the ZATCA’s regulations. With the help of ZATCA e-invoicing API integration capability, we make our system ZATCA compliant. All things considered, pick O2b for getting the ZATCA compliant e-invoicing solution and invoice your customers seamlessly.

USA

USA INDIA

INDIA