What is ERP in Financial Services?

The enterprise resource planning software system works as a holistic approach that helps the user to integrate various business processes into a unified platform and also gives them the liberty to manage the resources effectively. The financial service typically requires the system that gives them an apt solution, the ERP software for financial services includes:

Financial Management

The financial management is the module that incorporates the components like accounts payable/receivable, budgeting, and forecasting with a proper record of the ventures monetary unit.

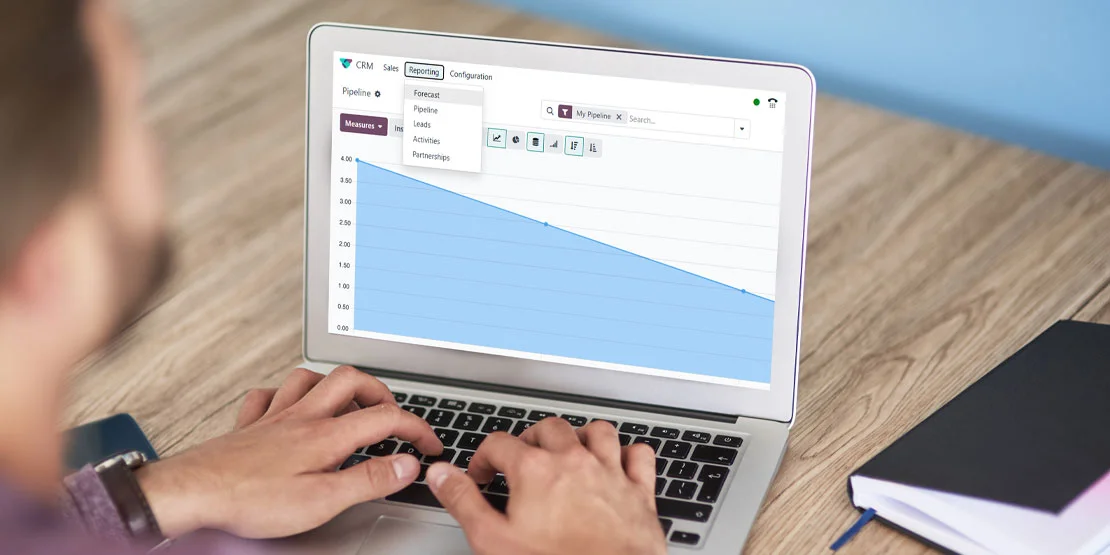

Customer Relationship Management (CRM)

It works on managing the overall customer interactions and the associated data.

Compliance Management

The module facilitates the regulatory requirements.

Risk Management

As the name suggest it helps the user in identifying and mitigating the financial risks.

Reporting and Analytics

The reporting and analytics works on generating the real-time insights into financial data to assist the venture with informed decision-making.

Overall if we look carefully the primary goal of the implementing process of an ERP system in financial services is to enhance the operational efficiency, improving the customer service, and maintaining the compliance with industry regulations and growth.

Looking for Odoo Implementation, Customization, Integration, or Support Services?

What are the Features that Financial Services ERP Software comes with?

Integrated Financial Management

A robust ERP solution like odoo comes with a comprehensive view into the financial data across the organization. The ERP integration also facilitate the real-time tracking of transactions, the advance cash flow management, and an accurate financial reporting.

Regulatory Compliance

An ERP system automates the process like reporting which also ensures the proper alignment of the financial activities as per the legal requirements.

Data Security

The financial data requires the most security and the ERP systems works perfectly with the sensitive data with advanced protection against unauthorized access and data breaches.

Benefits of Implementing ERP in Financial Services

Efficiency

In order to attain the efficiency through the ERP system it works on automation of routine jobs with gives more time to the employees and devoted it into the strategic initiatives.

Better Decision Making

Through the Access to real-time data analytics the organizations can make quick and more informed decisions which will actually improve their business agility.

Cost Saving

Streamlined processes that works on elimination of the inefficiencies overtime from the system and also saves sufficient time and resources.

Better Customer Service

Organizations can cultivate in better customer relationships through timely responses and appropriate services as the ERP software for financial services integrates the CRM features.

Assurance of Regulatory Compliance

The ERP comes with automated reporting on compliance that minimizes the chance of errors that could further hinder the organization process.

What are the Challenges that come with ERP implementation?

There is a short list of challenges that the user might face with the ERP software for financial services.

High Installation Costs

Challenges in the Change Management

Complexity in Integration

Data Migration Risks

Maintenance Requirements

Guidelines for Effective Implementation of an ERP in the Financial Services Sector

There are a set of few guidelines to conduct a successful ERP implementation project for your financial services sector:

Needs a Proper Analysis

The user must identify the needs of the stakeholders from different departments.

Understand the specific measurable, achievable goals, relevant documents or resources, and the allocated time as per the goals and objectives for the implementation project.

Choose the Right Vendor

Find an experienced vendor in terms of financial services.

The vendor should discuss on components like Scalability, customization, support services, pricing model, etc.

Have a Complete Implementation Plan

Understand your timelines and the associated milestones.

Work on building a team share them the tasks, and the resources.

Prepare with plans with expected problems that may occur during implementing.

Change Management Strategies

Employees must be updated with the changes for an easy adoption.

Different Training sessions should be conducted for different positions in the organization.

Track Progress every time

The progress made by the ERP implementation should be measured with established objectives like KPIs.

Progress in the implementation should be discussed with the stakeholders.

Which is the Best ERP software for financial services?

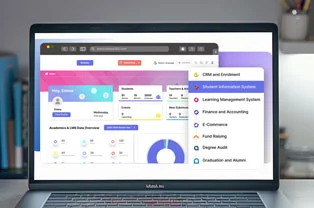

We are discussing about the Best ERP software for financial services, the answer is simple its odoo, it is a versatile enterprise resource planning system that also incorporates various advanced features under a single platform and also works on every business size and requirement. Also there are few reasons why odoo is best as the financial service ERP.

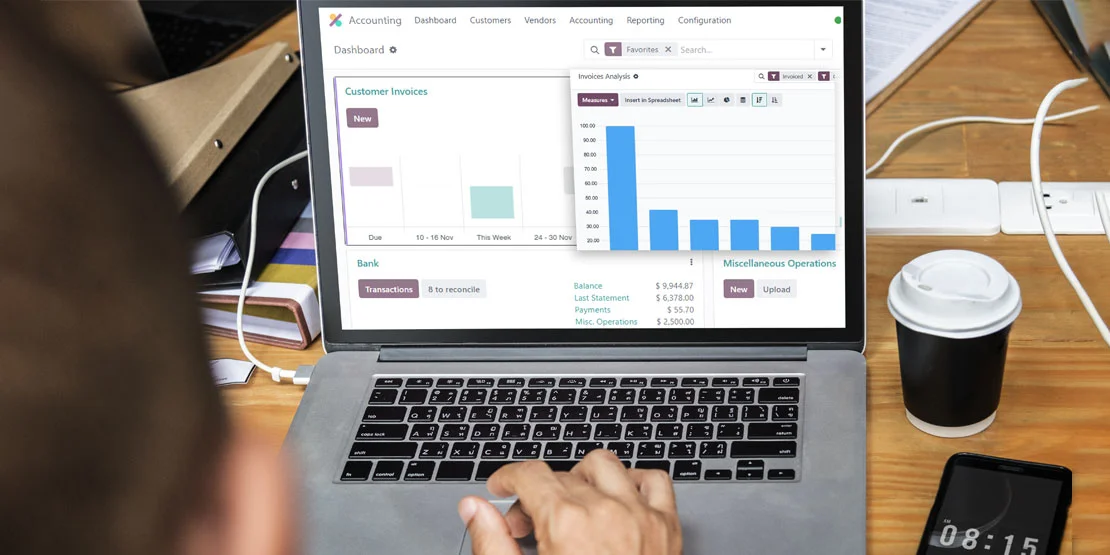

Integrated Financial Management

The software comes with integrated financial management. That includes functions like accounting, invoicing, budgeting, and reporting all under a single system. It also works on integration of various financial services that promotes the operational efficiency and the real-time visibility into their financial health.

Enhanced Compliance and Risk Management

Odoo ERP system works prefect with the highly regulated financial sector, it helps the organizations to navigate various complexities and regulate the landscapes effectively. The software also provides Risk Mitigation Tools that monitors and mitigate the financial risks.

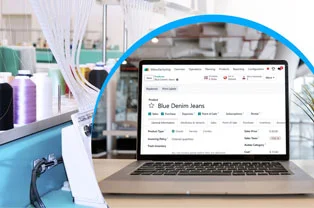

Streamlined Accounting Processes

The open-source Odoo ERP works on simplifying the accounting tasks through the processes like Automated Invoicing and Expense Tracking for a quicker and error less process.

Scalability and Flexibility

Odoo provides financial services that grow or evolve without significant disruptions. And also provides the options like Modular Designing and the easy Customizable Features with utmost flexibility according to each unique business processes.

Overall, odoo can be proven assist to your venture and also working with the ERP implementation partners like o2b technologies will bring additional benefits to the venture like Robust Security Features, User-Friendly Interface, Cost Efficiency and much more.

FAQs

Which ERP is best for financial services?

Odoo is the best ERP for financial services.

What does ERP means in the financial services?

The financial service helps the user to give the prefect business solution, the ERP software for financial services mainly works on the overall financial management while also including the components like accounts payable/receivable, the complex budgeting, and forecasting to boost the users firm productivity.

What are some of the common Challenges ERP implementation face in the financial service sector?

The challenges like Complexity in Integration, Transferring data from legacy systems into the new ERP, Ongoing Maintenance Requirements, etc.