Best ERP Software Solutions for the Banking Industry

Banking is an important industry that is used and is associated with various business sectors, in the world where the individuals are struggling with the complex financial operations, the ERP acts as a saver and help them to ease out the banking operations.

The ERP works on the efficiency and gives the customer a better satisfaction with each of their passing business functionality. It also gives the components like automation and streamlining the core banking process.

It further works on boosting the operational efficiency that helps the user to operate the bank smoothly and also helps the user to get a quicker respond with the evolving customer needs and requirements.

Why Banks Need an ERP?

It helps the user to perform all the key functionality of the organization more efficiently. The ERPs generally automate the operation, making it fast and progressive for the business venture

The ERP software solution works on the features like real-time reporting, account management, cash accounting and much more. These features together helps the user to conduct the operation in the banking industry.

ERP bank integration also helps the individuals to handle the growing operation of their venture, while also providing them scalability and visibility.

The ERP is beneficial in lowering down the overall implementation cost and eliminate the allover risk associated with the third-party ERP system.

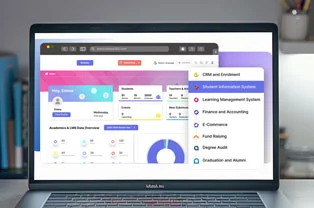

It also helps the user to have a customized ERP, which means the user will have a personalized dashboard also with the advanced feature and data security.

Working with the off-the shelf ERP brings the elements like affordability, gives the user a faster implementation and also works well in providing the vendor support for a smooth functionality.

Benefits of Using ERP Software for Banking

Centralized Data Management

ERP helps the user to centralize their important data, the customer data, transactions, interaction and much more. It also gives the user a complete or a holistic view of the overall customer history.

Streamlined Operations

It is a process of integration the ERP with the core banking system and providing the user with a streamlined operations thus it also reduce the chances of duplicate data and works on enhanced efficiency.

Customization

It works well on providing the user with the flexible modules and gives them a more personalized operations according to the bank needs, it also works on the service based operations according to the customer data and requirement.

Scalability

The ERP software solutions in the banking industry can be scaled easily and goes well with a larger customer range and a larger data volume. It also helps the user to add the new features with the business growth and demands.

Smooth Collaboration

It ensures an effective and smooth collaboration between the colleagues from all the banking departments, works well for the banking sector that works with the remote team for a more productive workflow.

Increased Data Security

It support the advanced security measures in order to avoid the chances of data breeching, the user can also easily monitor the operations and hence it offers the user with utmost transparency.

How ERP Software Solutions for the Banking Industry helps in growth?

Customer Segmentation

ERPs helps the banking sector to segregate their customers into the different groups based on their preferences, behaviors, the transaction history, and other important components of the banking sector. This also allows the banks to have a personalized financial advice and provide them with the specialized products, while also boosting the customer satisfaction.

Enhanced Marketing Campaigns

The user can understand the customer behavior patterns and monitor the various transactions, which further assist the owner to improve their marketing efforts and ensures that they have the solutions which are timely, relevant, and appealing according to the market trends.

Introduction to the new markets

ERPs, like odoo that supports the multi-currency further allows the user to have a smaller banking organization and expand it further with the emerging new markets, it also allows the user to expand their revenue streams and extend it on the global market.

Cross-Selling and Upselling Opportunities

The user can also gain the maximum benefit by analyzing their customer data, ERP systems can suggest the balancing financial products or services that targets the existing customers working on this approach will help the banking sector to grow.

Why is odoo the best ERP Software Solutions for the Banking Industry?

Odoo ERP is one of the most used solution for the banking industry due to its flexibility, affordable nature, and a set of wide features. It helps the user to addresses multiple key challenges and can work on the same as the regulatory compliance, operational complexity, and the customer expectations, while also empowering the overall financial sector to streamline the processes, enhance the process of decision-making, and further deliver the exceptional customer experiences.

Key Benefits of Odoo ERP for the Banking Sector:

Centralized Data Managemen

: Odoo ERP helps the user to centralize their important data, the customer data, transactions, interaction and much more. It also gives the user a complete or a holistic view of the overall customer history.

Automated Processe

: Odoo ERP offers the user with advanced automation features that are specifically made for the banking industry, it also includes the generating reports, tracking the overall transactions, and managing the customer data. Automation by odoo also helps the user to reduce the errors and allow the employees to focus more on the strategic tasks like data analysis and innovation.

Operational Efficiency

Automation of the core banking tasks and having a seamless integration works on various functions and helps the user to reduce their overall manual effort, while also enabling the employees to focus more on the strategic activities.

Cost-Effectiveness

Odoo is an open-source option in the ERP list and works on the modular design with advanced implementation and a lower maintenance costs, offering a significant ROI for the banking sector.

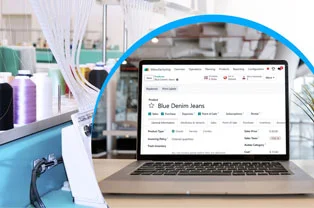

Scalability and Flexibility

Odoo’s modular architecture allows the bank to add a new set of features or modify their current features as per their needs with the evolving components for the scalability and adaptability.

Data Security

It comes with a built-in security measures, like the data encryption and access controls, it works well on protecting the users sensitive customer and financial data from the conditions like data breaches.

FAQs

What is Customer Segmentation ERP Software Solutions for the Banking Industry?

It is a process, that helps the induvial to divide the sector of business according to the components like the behaviors, the transaction history, this feature is generally used to make a personalized level of features for the user and further makes the venture operations standout in the market.

Why are the key features that comes with odoo ERP Software Solutions for the Banking Industry?

There are many features that comes with the Odoo ERP software solutions in the banking industry, and one of them is the centralized data management which means all the data is collected at a single place, for an easy access, it also works on segregating the data in the banking industry for an effective processing.

How does Customization help the user in the Banking Industry?

The customization option in the banking industry, assist the user in getting the flexible modules that further makes the bank solutions stand out in the market. It also helps the user in getting the service-based operations as per their customer data and requirement.

USA

USA INDIA

INDIA